Text

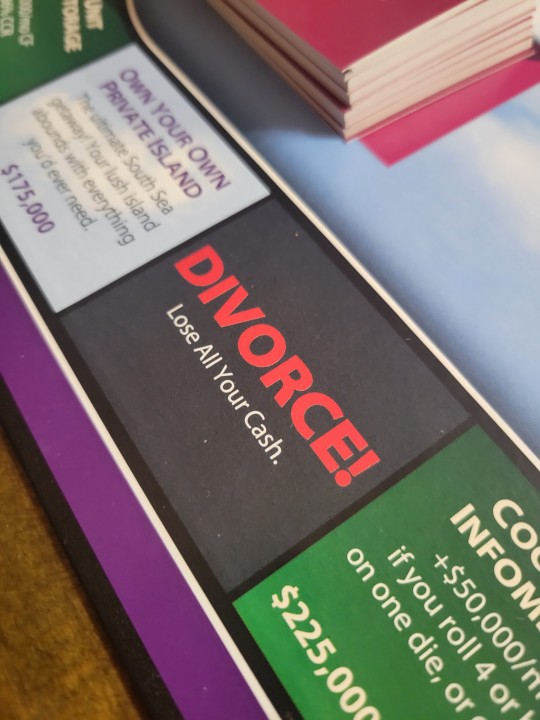

Last night we did a mini game night with friends and we played that stupid Rich Dad Poor Dad game (author is a hack and a liar) and I was peeved the entire time, but there was this space on the board

And whenever I was bored I'd just point at it and yell "Divorce!" and that was entertaining.

#personal#also you DONT lose all your cash in real divorce thats not how the system works#the game was SO inaccurate to real life#and under the guise of teaching someone how to be smart with money#yeah okay#except half the shit was luck#the video we watched about it beforehand talked about getting out of the rat race and have passive income#and like sure fine but when you are paycheque to paycheque you literally cant escape#additionally not everyone can have passive income#there has to be SOMEONE doing the labour#and those people deserve to be paid enough to live#the entire thing just makes me mad i hate it

8 notes

·

View notes

Text

svt gym rat bf things

I am re-starting my fitness journey, and what better to motivate me than being a casual (worrying) level of obsessed with svt. So yeah once again no one asked for this but here we are, writing it anyway

Warnings: some slightly suggestive material, going to the gym/fitness/working out is the topic, meals and eating mentioned

seungcheol

-he is 100% using any gym time with you to show off/impress you/remind you he's ya man, the most overtly sexy of the gym bfs

-likes to hold eye contact while he does hip thrusts. if he's really feeling it he'll get the weights as close to your actual weight as possible, looking at you while he stacks them all up.

-the BELT FLICKS.......the belt flicks. he does it on purpose. and by god you’re grateful.

-shamelessly ogles you the whole time

-he will slap your butt after spotting you for squats and call it his boyfriend tax

-knows you think he's sexy when he works his arms or chest so he always calls you over to spot and then smirks when you get flustered

-but he doesn’t anticipate how desperately whipped he becomes watching you work out (the post lift cardio session is always of a very specific genre if u know what I mean)

-also is a sucker for you in gym clothes and buys you new gym fits every other week

jeonghan

-only wants to go if you're going (poor boy is tired)

-really good at spotting though, always there to help if you need

-easily impressed when you do anything even remotely cool or beat your pr

-spends most of the time talking to you while you work out

-gets flustered when you do something he finds attractive but will NEVER admit it and tries to play it cool

-when he does finally get to the workout you are disgusted by how much bigger his arms are than yours

-i just know he got a fire gym playlist with barbiecore songs bc they get him hyped

joshua

-subtle flirting in the gym is this man's love language

-meets eyes with you and winks across the squat rack, "accidentally" grabs the same weight and your hands touch and he looks up at you all dramatically, leans against the mirror to chat you up

-all smiles even when he's lifting something really heavy if you're there

-makes a plan beforehand for what you're both working that day and checks in with you periodically to see how you're doing

-does silly dances to his gym playlist to make you laugh

-gives you hugs no matter how sweaty you are

-makes sure you push yourself just enough but never too hard

-the gym selfie king -- and he knows all your best angles

jun

-working out with him is a hazard because he always makes you laugh mid lift and you nearly drop what you're holding

-big proponent of stretching but mostly because he likes to see how flexible you are because he is a heaux

-he is also pretty dedicated to his workouts and knows how to keep on task at the gym, but thinks it's cute if you're bouncing off the walls a little

-switches earbuds with you while working out and then judges you when half of it is music he's a featured artist in

-he will challenge you to fake dance battles

-sneaks lil kisses between sets

hoshi

-cannot contain himself because YOU CAME TO THE GYM WITH HIM, goes way too hard, and complains for the next four days about how sore he is

-"races" you on the treadmill

-takes his shirt off because "he got too sweaty" but then gets suspiciously excited when you stare at him or compliment him

-you catch him staring at you all the time

-does his squats RIGHT IN FRONT OF YOUR FACE and then looks over his shoulder at u like "what r u looking at? perv"

-will do every single gym couples challenge with you, sends you videos throughout the week being like "we should try this"

wonwoo:

-another tired boy, but he does plan what he's going to work out at the gym every time and appreciates you following his schedule with him to keep each other on track

-workouts are usually not aerobic heavy so there's a lot of eye contact with him too

-cannot keep a smile off his face when you hype him up while he lifts, which is almost reason enough for him to do it

-is also super encouraging -- when you're challenging yourself to do something you've never done or trying to break a pr he's always so supportive and sweet

-lets you pick out matching gym fits to wear and always loves how happy you get when he comes out in his

jihoon:

-this man is the ultimate gym buddy and personal trainer

-if u express even a vague interest in working out he will sit you down to discuss goals and expectations and then come to your first gym session with a written, illustrated schedule targeting your specific body type & goals

-meal preps for u :(:(:(:(

-THE BEST spotter and also why do i feel like he has weird amounts of chiropractic knowledge and will be able to help you stretch SO well

-you can ask him any question about any workout and he knows the answer

-for some reason being in the gym with jihoon is so romantic to me like??? i feel like he'd be spotting you while you lift and he'd just lightly touch your arms to steady you and you'd be a blushing mess and so would he and then you'd go make out after

-worried you’re gonna get hurt so it’s sometimes hard for him to complete his workouts bc he’s watching your form

seokmin:

-going to the gym with seokmin would be a disaster in the best way

-will you work out? yes

-will it mostly be your abs, from laughing at him the entire time? also yes

-he will do bicep curls at you AGGRESSIVELY while he blasts careless whisper over the gym speakers

-his squats are all excuses to throw it back/twerk into you

-is also down for a couples challenge or two

-would be very complimentary of your muscles even if you don't feel like they're that good

-counts down your reps in a silly voice

-he ALSO has really good belt flicks but kind of by accident, and when he catches you blushing he'll tease you about it

mingyu:

-another elite-level gym buddy bf

-does love shots with your preworkout & makes the BEST post-gym meals

-he would also totally be that guy who has you kneel on his feet when he does sit-ups or lay beneath him while he does pushups so he can kiss you every time

-he is also an ogler. he will stare shamelessly at your butt as you walk by

-you might try to do a couples challenge once, but he's clumsy af and it didn't end well so you vowed never to do it again

-he's just a big baby so every time you exclaim over how nice his body is he'll get all shy

-also of course this man is posting up in a backwards baseball cap, a black skintight shirt, and gray sweatpants ON PURPOSE but he'll pretend he doesn't know he's committing literal crimes

-enthusiastically encourages you “one more rep babe one more you got this YEAHHHHH”

minghao:

-i see him more as a yoga/barre guy than a lifting guy

-also very good at stretching you out

-gets embarrassed when you watch him push through a difficult workout bc you're practically drooling at how attractive it is

-but he's also surprisingly goofy in the gym with you and makes sure you’re both having a good time

-loves to do those couple yoga poses and couple stretches

-also is down to help you with boxing or jiu jitsu moves

-post-gym glow is real on minghao

-hard to keep ur hands off each other after you get home hehehehehehehe

seungkwan:

-leg day is every day. so many squats are being done

-he also makes you laugh a lot

-for any aerobic workouts you are either getting in the pool with the grannies for water aerobics or ur doing Zumba there is no in between

-takes you on runs to beautiful spots in the city

-gets competitive about working out with you so if you do more reps than him or run a lil faster he pushes himself too hard

-is always prepared: the night before, he’ll set out your gym clothes, fill your water bottle and put it in the fridge, portion out the preworkout, etc

vernon:

-wants to share gym playlists, so he has one earbud of yours in the gym at all times

-surprises himself with how much he’s staring at you because wow he likes you in that tight shirt and leggings

-I can see him being really methodical about working out, so he kinda gets lost in it and forgets you’re alive, until you do your little dances around him

-he loves it when you show off for him so he can compliment you bc he’s kind of shy to do it without a reason bc then he’d have to admit how much he’s forgetting to work out because he’s paying attention to you

-gives you kisses to congratulate you when you reach milestones

chan

-he would also be elite level gym buddy bf

-uses gentle hands to correct your form if he’s worried you’re gonna hurt yourself 🫠

-he is also goofy in the gym but he also knows exactly when to be serious

-almost more committed to your goals than you are and goes buck wild when you reach a goal of any sort bc he is AN ADORABLE CUTIEPIE

-it’s the little things for him — like when you hum along to the song in your ears when you’re re-racking the smaller weights, he’s just so smitten with you

-idk why but I feel that he would be so good to you when you’re feeling that post gym soreness. he’s on that draw you an epsom salt bath, give you a massage, bring you Gatorade type beat

#seventeen#svt#svt fluff#svt x reader#svt imagines#svt reactions#maybe it’s just me but this makes it really easy to tell who my bias is#gym rat svt supremacy

288 notes

·

View notes

Text

More of this because I’m bored again. Deal with it.

Where did you lose your virginity, if you have? My apartment at the time What color car(s) do your parents drive? Mum has a black car, Dad has a red car. What are your views on getting rid of the penny? It's probably a good idea. God knows I never use one cent coins here in europe. Which Asian country would you most like to visit? Vietnam

Have you ever had a nosebleed? Maybe once or twice as kid. I did karate so it was pretty common to get hit in the face.

How far away do you live from your birthplace? At a guess I think it would be a couple of hours flight. I’ve never flown there from here.

Have you ever kissed someone underneath mistletoe? No Do you watch the Olympics on the television? I have watched a few events What was the scariest experience of your life? Nothing immediately springs to mind. I would have to think about it for longer. Have you ever played truth or dare? Of course How long is your driveway? I don’t have a driveway. The front door to my building is right on the street. Are there any tv shows you keep up with religiously? iZombie, Jane The Virgin, sometimes Brooklyn 99. Pretty much everything else I just wait for it to come out on netflix. Where is your mother right now? Probably at home asleep because it’s 6am there. Do you know anybody named Carl? Yeah and he’s American so all our friends in australia always did the long drawn out “Caaaaarrrrrrrrllllll... that kills people” from llamas in hats. Are you more of a night owl or a morning person? Night, for sure. What is your favorite song at the moment? I don’t specifically have one favourite song but I currently quite like Sofia by Alvaro Soler and Diferentes by Genitallica Do you have a weak stomach? Not really Have you ever been to a party where people were drinking underage? A couple in highschool How many stores are in the mall closest to you? I don’t even know which mall is closest to me. How far away is the closest McDonald’s to you? About 2 minutes walking. Literally never been there though. The only time I’ve had maccas in this country is in the airport. Would you ever meet someone in person that you met online? Yeah, I have before, many times. What was the last film you watched? I just finished watching Thor 2, so now I’m ready for when the third one is released here. Does it snow where you live? Maybe once every few years, but no, not usually. Have you ever been to an art gallery? Yes What are your neighbours like? I think they’re drug dealers actually, but they seem nice and they leave me alone. I do have to talk to them in the next couple of days though because the water bill came through and we have to split it between us because our apartments are on the same metre. Do you visit your town’s library often? Never been to a library in this city. Don’t even know where one is. Have you ever had to take care of an intoxicated person? Of course but tbh I usually try to pawn the responsibility off onto someone else. What flavor was the last ice cream you ate? Chocolate Can you do a cartwheel? If I try, probably I can do a shit one. Which website do you spend the most time on? Probably facebook bc it’s always open in the background. Have you ever kissed someone of a different race? Yeah What can you smell right now? Nothing noteable What accent is your favorite? I don’t have a favourite accent. It really depends on who’s talking and what they’re saying. Are/were you part of any extracurricular activities in school? Band What colors are on your country’s national flag? Red and yellow plus whatever colours are in the coat of arms

So, how was your day today? It was fine. I sent off some emails for potential jobs in the field I actually want to work in. Hopefully I get some responses. Then I played some mass effect, had a couple of drinks and watched a movie.

What are your plans for tomorrow? Probably the same as today.

When was the last time you actually smiled and meant it? I probably watched a funny video today at some point

I bet you’re in love with someone, who? I sure am not

What movie do you really want to see that’s out? I wouldn’t mind going to see kingsman golden circle. I’m also waiting for Thor 3 to come out here, which is tomorrow apparently as I’ve just discovered

What was the best memory made so far this year? So much has happened this year, there’s no way I could pick just one thing. I moved to a different continent, I’ve travelled in 6 countries, I’ve met new people (and a couple of boys), I’ve partied, I’ve hiked, I’ve had adventures and I’ve had boring days in at home. The entirety of this year has been amazing.

What’s your favorite sleeping position? Sort of fetal position, but with my torso twisted to face down, my hands tucked up under my chin, and my feet dangling off the side of the bed. I’ve been told I sleep in a weird position.

Who was the last person you kissed? Hasn’t changed since I filled one of these out yesterday

What does your day mostly consist of? Netflix and sleep tbh

Who did you last cry in front of? I have no idea when I last cried. I was probably alone though

Name five things that make you happy. Travel, netflix, my friends, alcohol, puppies

Do you wear white socks, or fun ones? I prefer to wear them crazy motherfuckers. Just shove every goddamn colour under the sun on there and that’s the shit I like keeping my feet warm.

Whats something you’re excited for? Whenever I can travel again

Would you ever lick a rat for $1,000? If it was a pet rat, sure. If I lick it multiple times do I get multiple thousands of dollars? Can I lick it 20 times in one go and then book a flight somewhere?

What was the last thing you highlighted? Probably some notes at work back in australia

How often do you shower? Every day.

Do you sleep with or without clothes on? With. Unless I’m not alone, in which case probably naked ;)

Who was the last person you talked on the phone with for over an hour? Who knows? I was probably a teenager. Or it was my dad

One thing you and your best friends always do when you hang out? Eat and watch a movie/tv show. Sometimes drink.

What were you doing at 12am last night? Sleeping

Call or text? Text.

What’s your favorite thing about Facebook? I can contact my friends in australia on there

Who is the first person you call when you have a bad day: My mum, if she’s awake. Otherwise I message friends.

What is your favorite ring on your phone? My ringtone is the themesong from buffy the vampire slayer

Who is the 2nd person on your missed call list on your cell phone? "Private number”

What shirt are you wearing? A stripey tshirt with a hoodie over it

Favorite age you have been so far? I don’t know. Now I guess ..?

Have you ever had a true one-night stand? No, I’ve always known the person beforehand, even if I only slept with them that one time, and even if I never saw them again after.

Would you like to date someone a lot purer than you? I don’t care..? I guess I’d prefer for them to have at least a little experience but I’m going to take it into consideration when I’m deciding whether to be with someone.

Would you prefer if good things happened, or interesting things? Preferably, the good things are also interesting.

Would you have kids with the last person you kissed? Nah

Have you ever been in someone’s wedding before? I’ve been to weddings, but not part of the bridal party.

How many times have you kissed the last person you kissed? Several times over the course of 2 weeks.

When was the last time you watched a movie in theaters? Whenever Spiderman Homecoming was out

Have you ever ruined someone’s life or planned to? No, I’m not that much of an asshole

Would you ever completely dye your hair the color green? Nah

What is your favorite food to eat around Christmas? On Christmas in Australia we eat fresh cherries and prawns (not together obvs). Also my dad’s full roast dinner

How much money do you have on you right now? I think I have like 80 euro in my wallet plus the massive piles of coins in 7 different currencies on my shelf Do the people in your town speak like rednecks? No What kind of pie do you like the best, if you like it at all? Aussie meat pies. That is literally the thing I miss most about australia. Like, I miss them more than I miss my mum. I’m so glad I had the forethough to eat a pie in the airport as my very last meal in australia. What is your dream career? Now taking suggestions

Have you ever thought of making love in a dressing room? No, I definitely have not. When was the last time you cried happy tears? Probably crying of laughter one of the many times in central america What kind of ice cream do you like the best? Ben and Jerry’s Half Baked. That’s the good shit. Would you ever go on one of those talent-searching shows? Actually, I auditioned for Australia’s got Talent like 2 days after I finished highschool. Didn’t make it to the section filmed in front of the judges though. But I did get to skip the first audition and a lot of the queue because I had big equipment (drum kit)

Is there anyone you wish would call you right now? I don’t wish, but I’d be happy if I was called by parents, any of my friends or the boy from central america. Has your house ever been broken in to? Yeah, some motherfucker broke into my place in aus and stole my goddamn potato. It’s almost 3 years later and I’m still bitter about it. Do you know someone who tends to eat all the time? Me Has anyone ever called you an “angel” before? Yeah haha What is your favorite restaraunt to go in and eat at? Orale in Panama City. So fucking fun.

When did you last spend the night at someone’s house? I spent a month in hotels while I was travelling. Before that, I guess it was when I stayed at a guy’s place in Madrid for a weekend in August I think.

Is your hamper currently overflowing? I throw all my dirty laundry directly into the washing machine and turn it on when it’s full. I probably should turn it on tomorrow.

Did you have intense night terrors as a child? Yes apparently

Know anybody who works in a tattoo parlor? I think one guy I met in Panama is a tattoo artist. Idk he was showing me pictures of tattoos he’d just done so I assume..

Have you ever played flashlight tag? I think I played it on karate camp a couple of times as a kid

Could you call yourself a movie buff? I would not

Skin tight tshirts or ones with flowy sleeves and such? Tight looks better on me but flowy is so much more comfortable

Robin Williams or Adam Sandler? Why? I hate adam sandler.

Have you ever shoplifted? No

Band that you really want to see in concert? Ehh tbh I’m kind of over concerts. Green Day are always good to see live because they’re very interactive but most bands aren’t like that. So there’s nobody I especially want to see. Actually, maybe Ricky Martin...

Are you a shorts wearing kind of person? When I went to India I packed shorts in my suitcase and even though it was over 40 degrees every day of the trip, I still never wore them. So no, I’m not a shorts wearing kind of person.

Is your grandparents’ house obsessively tidy? No, but my dad’s is.

Do you prefer to tape or tack up posters to your walls? I have not had a poster up in several years but I used to always use blutack.

When you cook, do you like to throw in random things? I usually only buy what I’m going to use but sometimes if I find something I’ll chuck it in.

Have you ever ducttaped somebody’s mouth shut? I probably have at some point in my life

Is anybody in your family a carpenter? No, but my dad is very good at making things. He is a luthier.

1 note

·

View note

Text

BLACK SWAN STOPPED BITCOIN RALLY ? IMPORTANT RESISTANCE!!! BITCOIN TRADING IN A RISING WEDGE ?!?

VIDEO TRANSCRIPT

MARK COLVIN In today’s video, Bitcoin tried to break out the upside, but eventually, Bitcoin got rejected by any resistance. I want to have a look at that resistance level and why it is so significant. And in today’s video, I want to have a look as well at the possibility that the Black Swan event that we have seen that that might have stopped Bitcoins previous rally and that the price signal we are seeing on the hash ribbon right now is a repeated buy signal from Beheshti Rubin. We have seen before and right now it looks like Bitcoin is trading in this racing, which baited anyone to talk about the exact price levels that I’m watching in the bitcoin place to t to mind if we are going to see a break out to the upside and we can expect more bullish price action over when we are seeing a breakout to the downside and we can expect more bearish price action. So guys, all about that in today’s video. With that being said, my name is sure. This is the blockchain today deal channel where you subscribe for daily crypto videos. And right now, let’s jump into the content. Bitcoin’s price is still climbing. And let’s start off with having a look on the weekly timeframe. And here we can see this orange line right here and at this, the 20 weeks moving average. And in the history of bitcoin, it has been quite a significant moving average, because most of the time it was indicating whether we are in a bull or in a bear market. If we broke above the 20-week moving average, we often saw a nice run-up. And when we break below the 20-week moving average, it often acts as we shift stance. And as you can see right now, the 20-week moving average is acting as resistance. But this moving effort is lining up as well with a not a moving average, which is quite significant, and that is the 200 daily moving average. So let’s have a look into that. The 20-week moving average is right now at a proximately seven point eight K edit1, a daily moving average is right now at seven point nine case clear. There’s a little bit difference between those two, but those are both quite significant moving efforts. If we were to break a buffet and get a daily weekly close both those levels, then that is definitely looking fairly bullish for Bitcoin in the short term. In the short term time frame, it looks like the bulls starting to lose momentum. And let’s have a look what happened yesterday. So we were trading in this range almost perfectly in his range. We had actually some fake-outs here. We had a fake-out. I count consider this as well as a fake-out. Right now, we did have a break above the level. We tested the resistance. And I want to have a talk about that resistance and why I think this resistance is so significant. We got rejected. But if we have a look at the volume, we haven’t seen much increase in volume. But guys, let’s have a look at this. Reshift this line, because this resistance line is actually giving us a lot of information. Let’s shoot out the price of bitcoin. Let’s go to before our time frame so you can see right here after we had this huge dump, we bounce back up and we came. Yeah, exactly. To two. This was just this line. We tested it another time afterwards. And right now we are testing the same level again. And guys, this better’n is a rising retched Bethan and generally a rising, which is a better spread than 40. Chances are more likely that the price will break out to the downside wider than to the upside. Doesn’t mean that the price cannot break out to the upside. Of course, the price can as well break out to the upside. And the resistance of this rising ratch right now is aligning with the twenty-week moving average and its one-day moving average is slightly above that. So there is quite some resistance right now. Any bitcoin charts. So that means it’s going to be a hard time for Bitcoin to really break above those levels. But if Bitcoin breaks above those levels and can hold those levels, then that is definitely looking very bullish. But right now, I think we are trading in this channel in this rising wedge pattern. And when we have a look at the momentum indicators, I want to show you two divergences which are showing that the bulls are losing a little bit of their steam. And this first one is on the fly with time frame. We can see in the abbasi we are making a lower high right and indeed price we are making a high a high that is a bearish divergence. And that can tell us that the bulls are losing a little bit of their power and that the bearish momentum might step into the price of bitcoin. Although I do want to say from this bearish divergence before our time frame, it is not fishable on different timeframes. And most of the time it is a good confirmation when you can find these divergences on different timeframes as well. And guys, when we. Having a look at the one-hour time frame, we can see a bearish divergence as well. And Idrissi RSI. We can clearly see that every side is making a low a high end in the price. We clearly made a high a high. So that tells me that we might see some bearish momentum in the short term time frame, which could mean that we would test the support right here again, or which could as well mean that we come down and test the support of the rising, which in the near future. Ben, guys, I would like to have a look at a comment I received yesterday and I thought it is quite an interesting thought. I want to bring that up. So, Paul Rucci, he shaved about yesterday’s video. I don’t agree. You are too bearish. The capitalization at the beginning of March was a black swan event. Simply, it wasn’t meant to happen. The current has driven by is a reinforcing signal of the previous one. They are at the same price point. Previously, prices never fell significantly below the price point at the Hashwi have been by a signal. It’s going up and guys who want to have a small talk about this common because I do think Paul Rugy got a point right here and I’m just thinking about it in yesterday’s video hour. Let’s have a look at what Paul Butchie is saying here. Bull Butchy was saying is actually that this was the bottom face and this was as well the accumulation phase. And this might be a similar period as we have seen right there. So right here, we showed a minor capitulation and we saw the accumulation going on. And eventually, we got a buy signal right here. Right. And what could be the case is that after we got this buy signal, we broke out to the upside. We had this rally. But yeah, this rally stopped out right here at a proximately ten thousand and five hundred U.S. dollar. And now comes to the big question, would that really have been stopped? If we wouldn’t see this crisis right now, if we wouldn’t have that big sell-off, any stock market soared. Afterwards, we had this black swan event. And guys, a black swan event is an extremely rare event with Seafair consequences. It cannot be predicted beforehand, though many claims it should be predictable after the fact. Black Swan fans can cause catastrophic damage to an economy, and because they can not be predicted, can only be prepared for by building robust systems. Reliance on standard forecasting tools can both fail to predict and potentially increase full of ability to black swans by propagating risks and offering false security. So guys, the black swan event that we have been seeing, that is, of course, the Coldfoot 19 crises. It had severe consequences for the economy. And yet you couldn’t predict that with normal indicators we couldn’t see on the average. I write that there is a yeah, that there is a black swan event coming, that the Coldfoot 19 crisis is going to crash the stock markets. So yeah, what bull which what you’re saying is that this was the normal price action. We had this buy signal which was very bullish. Eventually, we broke out to the upside, but we got stopped. We got stopped due to this black swan event. And eventually, that makes this a repeat of the previous one. And I do think you can we can say something about this because it is an interesting fourth. I think it is definitely interesting because we had a buy signal right here. And eventually, yes, we got a black swan event and death led us to this minor capitulation. And guys, that is also important right here is one of the times we are seeing the price dumping first and afterwards we are seeing the minor capitulation. And that is logical because there is a black swan event. The economy is crashing. Surely the bitcoin price is crashing as well. And this liquidity crisis and therefore miners, they stop their operations because they simply cannot pay for the operations anymore. So they are forced to shut down, which eventually leads in capitulation in the hesh right here. So we have a price stock eventually that leads to capitulation. The Heshbon, for example, right here. It was slightly different because here we had still these price actions and we already saw capitulation happening before the dump. There was actually a very nice indicator right here that we are seeing the inversion of the hash Rayborn and afterwards the price plummets. So I think we can definitely say that this drop was as well cost by the selling pressure of the miners because we can see that back right here. These troughs are not crossed by yourself. Question of the miners. These drops eventually led to miner capitulation. And that is the interesting fourth right here. And I do think that. Yeah. Paul Voce has a point right here. We have to consider that take that into account because as well, we can see by signal right now it’s appearing at an A-s at approximately. A similar price actually, right in this rat range. So, guys. Now comes the big question. Does that make it possible that we are going to trade in this range and we will have a break out to the upside? Well, guys, that is definitely possible. And personally, I don’t think that it is the most likely scenario. I think when we have found a bottom in the stock market, that will be the moment that we are going to see a rush to sound money. We’re going to see a rush to bitcoin and gold. And right now, I’m not yet consensus that we have found a bottom in the stock market. And guys, my view on this is that indeed, I don’t think we have found a bottom in the stock market. I think we can see it is logical to see not a sell-off in the stock market. And I think the short term that that will have an impact on Bitcoin as well. I don’t think that they are fundamentally correlated as in that the price strife of the S&P 500 is similar to the price drive of Bitcoin. But I think in a crisis, the price drive. First, the fundamental price drivers are the same. And the fundamental price drive for any crisis is that everybody needs money to survive. Am I bullish on bitcoin? Yes, I’m definitely very, very bullish on bitcoin right now. We are getting a lot of bullish signals. Why? The fundamentals are looking very bullish price-wise. It’s looking very bullish. I definitely think we have seen the bottom. Any previous drop that was most likely the bottom. We are never going to get below those prices again. That is what I am thinking. But I do think that in the short term, bitcoin could still see some lowered levels to retest some lower levels. And I have some clear levels that I am watching, of course. And the first level is the resistance of the rising wedge pattern, which is aligning with the 20-week moving average. And of course, if we get a weekly close above the 20 weeks moving effort that is very bullish for Bitcoin, any short and mid-term, I would say the 200 daily moving average is slightly above that at 7.9. If we would get a daily close above that level, then that would be fairly bullish as well. I think in both scenarios we should get the confirmation that the levels are getting back tested as support as well. But I first want to see the price breakthrough and hold those levels. I think right now we are still trading in this formation. We can see the before you must still decline. We have clear support and resistance pattern-wise. It is a rising wedge pattern. And I do see some signs that there might be some bearish momentum coming into the bitcoin price in the short term. With this bearish, the Fed is only for our time frame and a balance that verges on the 1-hour time frame. But again, guys, that voices for today’s video, I hope you all enjoyed it. If so, please leave a thumbs up and let me know what you think about my analysers. Do you think Bull Ruki can be right? Was the Black Swan event something that held bitcoin down from rallying further in the past? Esti by signalling the hedge ribboned right now just a repeated version of the buy signal we have seen before. Guys, I want to know what you think. Let me know in the comments section down below and if you want to learn how to trade bitcoin, you can watch one of my tutorials and guides. I will see you all tomorrow. And don’t forget to huddle.

source https://www.cryptosharks.net/black-swan-stopped-bitcoin-rally/ source https://cryptosharks1.blogspot.com/2020/04/black-swan-stopped-bitcoin-rally.html

0 notes

Text

BLACK SWAN STOPPED BITCOIN RALLY ? IMPORTANT RESISTANCE!!! BITCOIN TRADING IN A RISING WEDGE ?!?

VIDEO TRANSCRIPT

MARK COLVIN In today’s video, Bitcoin tried to break out the upside, but eventually, Bitcoin got rejected by any resistance. I want to have a look at that resistance level and why it is so significant. And in today’s video, I want to have a look as well at the possibility that the Black Swan event that we have seen that that might have stopped Bitcoins previous rally and that the price signal we are seeing on the hash ribbon right now is a repeated buy signal from Beheshti Rubin. We have seen before and right now it looks like Bitcoin is trading in this racing, which baited anyone to talk about the exact price levels that I’m watching in the bitcoin place to t to mind if we are going to see a break out to the upside and we can expect more bullish price action over when we are seeing a breakout to the downside and we can expect more bearish price action. So guys, all about that in today’s video. With that being said, my name is sure. This is the blockchain today deal channel where you subscribe for daily crypto videos. And right now, let’s jump into the content. Bitcoin’s price is still climbing. And let’s start off with having a look on the weekly timeframe. And here we can see this orange line right here and at this, the 20 weeks moving average. And in the history of bitcoin, it has been quite a significant moving average, because most of the time it was indicating whether we are in a bull or in a bear market. If we broke above the 20-week moving average, we often saw a nice run-up. And when we break below the 20-week moving average, it often acts as we shift stance. And as you can see right now, the 20-week moving average is acting as resistance. But this moving effort is lining up as well with a not a moving average, which is quite significant, and that is the 200 daily moving average. So let’s have a look into that. The 20-week moving average is right now at a proximately seven point eight K edit1, a daily moving average is right now at seven point nine case clear. There’s a little bit difference between those two, but those are both quite significant moving efforts. If we were to break a buffet and get a daily weekly close both those levels, then that is definitely looking fairly bullish for Bitcoin in the short term. In the short term time frame, it looks like the bulls starting to lose momentum. And let’s have a look what happened yesterday. So we were trading in this range almost perfectly in his range. We had actually some fake-outs here. We had a fake-out. I count consider this as well as a fake-out. Right now, we did have a break above the level. We tested the resistance. And I want to have a talk about that resistance and why I think this resistance is so significant. We got rejected. But if we have a look at the volume, we haven’t seen much increase in volume. But guys, let’s have a look at this. Reshift this line, because this resistance line is actually giving us a lot of information. Let’s shoot out the price of bitcoin. Let’s go to before our time frame so you can see right here after we had this huge dump, we bounce back up and we came. Yeah, exactly. To two. This was just this line. We tested it another time afterwards. And right now we are testing the same level again. And guys, this better’n is a rising retched Bethan and generally a rising, which is a better spread than 40. Chances are more likely that the price will break out to the downside wider than to the upside. Doesn’t mean that the price cannot break out to the upside. Of course, the price can as well break out to the upside. And the resistance of this rising ratch right now is aligning with the twenty-week moving average and its one-day moving average is slightly above that. So there is quite some resistance right now. Any bitcoin charts. So that means it’s going to be a hard time for Bitcoin to really break above those levels. But if Bitcoin breaks above those levels and can hold those levels, then that is definitely looking very bullish. But right now, I think we are trading in this channel in this rising wedge pattern. And when we have a look at the momentum indicators, I want to show you two divergences which are showing that the bulls are losing a little bit of their steam. And this first one is on the fly with time frame. We can see in the abbasi we are making a lower high right and indeed price we are making a high a high that is a bearish divergence. And that can tell us that the bulls are losing a little bit of their power and that the bearish momentum might step into the price of bitcoin. Although I do want to say from this bearish divergence before our time frame, it is not fishable on different timeframes. And most of the time it is a good confirmation when you can find these divergences on different timeframes as well. And guys, when we. Having a look at the one-hour time frame, we can see a bearish divergence as well. And Idrissi RSI. We can clearly see that every side is making a low a high end in the price. We clearly made a high a high. So that tells me that we might see some bearish momentum in the short term time frame, which could mean that we would test the support right here again, or which could as well mean that we come down and test the support of the rising, which in the near future. Ben, guys, I would like to have a look at a comment I received yesterday and I thought it is quite an interesting thought. I want to bring that up. So, Paul Rucci, he shaved about yesterday’s video. I don’t agree. You are too bearish. The capitalization at the beginning of March was a black swan event. Simply, it wasn’t meant to happen. The current has driven by is a reinforcing signal of the previous one. They are at the same price point. Previously, prices never fell significantly below the price point at the Hashwi have been by a signal. It’s going up and guys who want to have a small talk about this common because I do think Paul Rugy got a point right here and I’m just thinking about it in yesterday’s video hour. Let’s have a look at what Paul Butchie is saying here. Bull Butchy was saying is actually that this was the bottom face and this was as well the accumulation phase. And this might be a similar period as we have seen right there. So right here, we showed a minor capitulation and we saw the accumulation going on. And eventually, we got a buy signal right here. Right. And what could be the case is that after we got this buy signal, we broke out to the upside. We had this rally. But yeah, this rally stopped out right here at a proximately ten thousand and five hundred U.S. dollar. And now comes to the big question, would that really have been stopped? If we wouldn’t see this crisis right now, if we wouldn’t have that big sell-off, any stock market soared. Afterwards, we had this black swan event. And guys, a black swan event is an extremely rare event with Seafair consequences. It cannot be predicted beforehand, though many claims it should be predictable after the fact. Black Swan fans can cause catastrophic damage to an economy, and because they can not be predicted, can only be prepared for by building robust systems. Reliance on standard forecasting tools can both fail to predict and potentially increase full of ability to black swans by propagating risks and offering false security. So guys, the black swan event that we have been seeing, that is, of course, the Coldfoot 19 crises. It had severe consequences for the economy. And yet you couldn’t predict that with normal indicators we couldn’t see on the average. I write that there is a yeah, that there is a black swan event coming, that the Coldfoot 19 crisis is going to crash the stock markets. So yeah, what bull which what you’re saying is that this was the normal price action. We had this buy signal which was very bullish. Eventually, we broke out to the upside, but we got stopped. We got stopped due to this black swan event. And eventually, that makes this a repeat of the previous one. And I do think you can we can say something about this because it is an interesting fourth. I think it is definitely interesting because we had a buy signal right here. And eventually, yes, we got a black swan event and death led us to this minor capitulation. And guys, that is also important right here is one of the times we are seeing the price dumping first and afterwards we are seeing the minor capitulation. And that is logical because there is a black swan event. The economy is crashing. Surely the bitcoin price is crashing as well. And this liquidity crisis and therefore miners, they stop their operations because they simply cannot pay for the operations anymore. So they are forced to shut down, which eventually leads in capitulation in the hesh right here. So we have a price stock eventually that leads to capitulation. The Heshbon, for example, right here. It was slightly different because here we had still these price actions and we already saw capitulation happening before the dump. There was actually a very nice indicator right here that we are seeing the inversion of the hash Rayborn and afterwards the price plummets. So I think we can definitely say that this drop was as well cost by the selling pressure of the miners because we can see that back right here. These troughs are not crossed by yourself. Question of the miners. These drops eventually led to miner capitulation. And that is the interesting fourth right here. And I do think that. Yeah. Paul Voce has a point right here. We have to consider that take that into account because as well, we can see by signal right now it’s appearing at an A-s at approximately. A similar price actually, right in this rat range. So, guys. Now comes the big question. Does that make it possible that we are going to trade in this range and we will have a break out to the upside? Well, guys, that is definitely possible. And personally, I don’t think that it is the most likely scenario. I think when we have found a bottom in the stock market, that will be the moment that we are going to see a rush to sound money. We’re going to see a rush to bitcoin and gold. And right now, I’m not yet consensus that we have found a bottom in the stock market. And guys, my view on this is that indeed, I don’t think we have found a bottom in the stock market. I think we can see it is logical to see not a sell-off in the stock market. And I think the short term that that will have an impact on Bitcoin as well. I don’t think that they are fundamentally correlated as in that the price strife of the S&P 500 is similar to the price drive of Bitcoin. But I think in a crisis, the price drive. First, the fundamental price drivers are the same. And the fundamental price drive for any crisis is that everybody needs money to survive. Am I bullish on bitcoin? Yes, I’m definitely very, very bullish on bitcoin right now. We are getting a lot of bullish signals. Why? The fundamentals are looking very bullish price-wise. It’s looking very bullish. I definitely think we have seen the bottom. Any previous drop that was most likely the bottom. We are never going to get below those prices again. That is what I am thinking. But I do think that in the short term, bitcoin could still see some lowered levels to retest some lower levels. And I have some clear levels that I am watching, of course. And the first level is the resistance of the rising wedge pattern, which is aligning with the 20-week moving average. And of course, if we get a weekly close above the 20 weeks moving effort that is very bullish for Bitcoin, any short and mid-term, I would say the 200 daily moving average is slightly above that at 7.9. If we would get a daily close above that level, then that would be fairly bullish as well. I think in both scenarios we should get the confirmation that the levels are getting back tested as support as well. But I first want to see the price breakthrough and hold those levels. I think right now we are still trading in this formation. We can see the before you must still decline. We have clear support and resistance pattern-wise. It is a rising wedge pattern. And I do see some signs that there might be some bearish momentum coming into the bitcoin price in the short term. With this bearish, the Fed is only for our time frame and a balance that verges on the 1-hour time frame. But again, guys, that voices for today’s video, I hope you all enjoyed it. If so, please leave a thumbs up and let me know what you think about my analysers. Do you think Bull Ruki can be right? Was the Black Swan event something that held bitcoin down from rallying further in the past? Esti by signalling the hedge ribboned right now just a repeated version of the buy signal we have seen before. Guys, I want to know what you think. Let me know in the comments section down below and if you want to learn how to trade bitcoin, you can watch one of my tutorials and guides. I will see you all tomorrow. And don’t forget to huddle.

source https://www.cryptosharks.net/black-swan-stopped-bitcoin-rally/ source https://cryptosharks1.tumblr.com/post/616660118502834176

0 notes

Text

BLACK SWAN STOPPED BITCOIN RALLY ? IMPORTANT RESISTANCE!!! BITCOIN TRADING IN A RISING WEDGE ?!?

VIDEO TRANSCRIPT

MARK COLVIN In today’s video, Bitcoin tried to break out the upside, but eventually, Bitcoin got rejected by any resistance. I want to have a look at that resistance level and why it is so significant. And in today’s video, I want to have a look as well at the possibility that the Black Swan event that we have seen that that might have stopped Bitcoins previous rally and that the price signal we are seeing on the hash ribbon right now is a repeated buy signal from Beheshti Rubin. We have seen before and right now it looks like Bitcoin is trading in this racing, which baited anyone to talk about the exact price levels that I’m watching in the bitcoin place to t to mind if we are going to see a break out to the upside and we can expect more bullish price action over when we are seeing a breakout to the downside and we can expect more bearish price action. So guys, all about that in today’s video. With that being said, my name is sure. This is the blockchain today deal channel where you subscribe for daily crypto videos. And right now, let’s jump into the content. Bitcoin’s price is still climbing. And let’s start off with having a look on the weekly timeframe. And here we can see this orange line right here and at this, the 20 weeks moving average. And in the history of bitcoin, it has been quite a significant moving average, because most of the time it was indicating whether we are in a bull or in a bear market. If we broke above the 20-week moving average, we often saw a nice run-up. And when we break below the 20-week moving average, it often acts as we shift stance. And as you can see right now, the 20-week moving average is acting as resistance. But this moving effort is lining up as well with a not a moving average, which is quite significant, and that is the 200 daily moving average. So let’s have a look into that. The 20-week moving average is right now at a proximately seven point eight K edit1, a daily moving average is right now at seven point nine case clear. There’s a little bit difference between those two, but those are both quite significant moving efforts. If we were to break a buffet and get a daily weekly close both those levels, then that is definitely looking fairly bullish for Bitcoin in the short term. In the short term time frame, it looks like the bulls starting to lose momentum. And let’s have a look what happened yesterday. So we were trading in this range almost perfectly in his range. We had actually some fake-outs here. We had a fake-out. I count consider this as well as a fake-out. Right now, we did have a break above the level. We tested the resistance. And I want to have a talk about that resistance and why I think this resistance is so significant. We got rejected. But if we have a look at the volume, we haven’t seen much increase in volume. But guys, let’s have a look at this. Reshift this line, because this resistance line is actually giving us a lot of information. Let’s shoot out the price of bitcoin. Let’s go to before our time frame so you can see right here after we had this huge dump, we bounce back up and we came. Yeah, exactly. To two. This was just this line. We tested it another time afterwards. And right now we are testing the same level again. And guys, this better’n is a rising retched Bethan and generally a rising, which is a better spread than 40. Chances are more likely that the price will break out to the downside wider than to the upside. Doesn’t mean that the price cannot break out to the upside. Of course, the price can as well break out to the upside. And the resistance of this rising ratch right now is aligning with the twenty-week moving average and its one-day moving average is slightly above that. So there is quite some resistance right now. Any bitcoin charts. So that means it’s going to be a hard time for Bitcoin to really break above those levels. But if Bitcoin breaks above those levels and can hold those levels, then that is definitely looking very bullish. But right now, I think we are trading in this channel in this rising wedge pattern. And when we have a look at the momentum indicators, I want to show you two divergences which are showing that the bulls are losing a little bit of their steam. And this first one is on the fly with time frame. We can see in the abbasi we are making a lower high right and indeed price we are making a high a high that is a bearish divergence. And that can tell us that the bulls are losing a little bit of their power and that the bearish momentum might step into the price of bitcoin. Although I do want to say from this bearish divergence before our time frame, it is not fishable on different timeframes. And most of the time it is a good confirmation when you can find these divergences on different timeframes as well. And guys, when we. Having a look at the one-hour time frame, we can see a bearish divergence as well. And Idrissi RSI. We can clearly see that every side is making a low a high end in the price. We clearly made a high a high. So that tells me that we might see some bearish momentum in the short term time frame, which could mean that we would test the support right here again, or which could as well mean that we come down and test the support of the rising, which in the near future. Ben, guys, I would like to have a look at a comment I received yesterday and I thought it is quite an interesting thought. I want to bring that up. So, Paul Rucci, he shaved about yesterday’s video. I don’t agree. You are too bearish. The capitalization at the beginning of March was a black swan event. Simply, it wasn’t meant to happen. The current has driven by is a reinforcing signal of the previous one. They are at the same price point. Previously, prices never fell significantly below the price point at the Hashwi have been by a signal. It’s going up and guys who want to have a small talk about this common because I do think Paul Rugy got a point right here and I’m just thinking about it in yesterday’s video hour. Let’s have a look at what Paul Butchie is saying here. Bull Butchy was saying is actually that this was the bottom face and this was as well the accumulation phase. And this might be a similar period as we have seen right there. So right here, we showed a minor capitulation and we saw the accumulation going on. And eventually, we got a buy signal right here. Right. And what could be the case is that after we got this buy signal, we broke out to the upside. We had this rally. But yeah, this rally stopped out right here at a proximately ten thousand and five hundred U.S. dollar. And now comes to the big question, would that really have been stopped? If we wouldn’t see this crisis right now, if we wouldn’t have that big sell-off, any stock market soared. Afterwards, we had this black swan event. And guys, a black swan event is an extremely rare event with Seafair consequences. It cannot be predicted beforehand, though many claims it should be predictable after the fact. Black Swan fans can cause catastrophic damage to an economy, and because they can not be predicted, can only be prepared for by building robust systems. Reliance on standard forecasting tools can both fail to predict and potentially increase full of ability to black swans by propagating risks and offering false security. So guys, the black swan event that we have been seeing, that is, of course, the Coldfoot 19 crises. It had severe consequences for the economy. And yet you couldn’t predict that with normal indicators we couldn’t see on the average. I write that there is a yeah, that there is a black swan event coming, that the Coldfoot 19 crisis is going to crash the stock markets. So yeah, what bull which what you’re saying is that this was the normal price action. We had this buy signal which was very bullish. Eventually, we broke out to the upside, but we got stopped. We got stopped due to this black swan event. And eventually, that makes this a repeat of the previous one. And I do think you can we can say something about this because it is an interesting fourth. I think it is definitely interesting because we had a buy signal right here. And eventually, yes, we got a black swan event and death led us to this minor capitulation. And guys, that is also important right here is one of the times we are seeing the price dumping first and afterwards we are seeing the minor capitulation. And that is logical because there is a black swan event. The economy is crashing. Surely the bitcoin price is crashing as well. And this liquidity crisis and therefore miners, they stop their operations because they simply cannot pay for the operations anymore. So they are forced to shut down, which eventually leads in capitulation in the hesh right here. So we have a price stock eventually that leads to capitulation. The Heshbon, for example, right here. It was slightly different because here we had still these price actions and we already saw capitulation happening before the dump. There was actually a very nice indicator right here that we are seeing the inversion of the hash Rayborn and afterwards the price plummets. So I think we can definitely say that this drop was as well cost by the selling pressure of the miners because we can see that back right here. These troughs are not crossed by yourself. Question of the miners. These drops eventually led to miner capitulation. And that is the interesting fourth right here. And I do think that. Yeah. Paul Voce has a point right here. We have to consider that take that into account because as well, we can see by signal right now it’s appearing at an A-s at approximately. A similar price actually, right in this rat range. So, guys. Now comes the big question. Does that make it possible that we are going to trade in this range and we will have a break out to the upside? Well, guys, that is definitely possible. And personally, I don’t think that it is the most likely scenario. I think when we have found a bottom in the stock market, that will be the moment that we are going to see a rush to sound money. We’re going to see a rush to bitcoin and gold. And right now, I’m not yet consensus that we have found a bottom in the stock market. And guys, my view on this is that indeed, I don’t think we have found a bottom in the stock market. I think we can see it is logical to see not a sell-off in the stock market. And I think the short term that that will have an impact on Bitcoin as well. I don’t think that they are fundamentally correlated as in that the price strife of the S&P 500 is similar to the price drive of Bitcoin. But I think in a crisis, the price drive. First, the fundamental price drivers are the same. And the fundamental price drive for any crisis is that everybody needs money to survive. Am I bullish on bitcoin? Yes, I’m definitely very, very bullish on bitcoin right now. We are getting a lot of bullish signals. Why? The fundamentals are looking very bullish price-wise. It’s looking very bullish. I definitely think we have seen the bottom. Any previous drop that was most likely the bottom. We are never going to get below those prices again. That is what I am thinking. But I do think that in the short term, bitcoin could still see some lowered levels to retest some lower levels. And I have some clear levels that I am watching, of course. And the first level is the resistance of the rising wedge pattern, which is aligning with the 20-week moving average. And of course, if we get a weekly close above the 20 weeks moving effort that is very bullish for Bitcoin, any short and mid-term, I would say the 200 daily moving average is slightly above that at 7.9. If we would get a daily close above that level, then that would be fairly bullish as well. I think in both scenarios we should get the confirmation that the levels are getting back tested as support as well. But I first want to see the price breakthrough and hold those levels. I think right now we are still trading in this formation. We can see the before you must still decline. We have clear support and resistance pattern-wise. It is a rising wedge pattern. And I do see some signs that there might be some bearish momentum coming into the bitcoin price in the short term. With this bearish, the Fed is only for our time frame and a balance that verges on the 1-hour time frame. But again, guys, that voices for today’s video, I hope you all enjoyed it. If so, please leave a thumbs up and let me know what you think about my analysers. Do you think Bull Ruki can be right? Was the Black Swan event something that held bitcoin down from rallying further in the past? Esti by signalling the hedge ribboned right now just a repeated version of the buy signal we have seen before. Guys, I want to know what you think. Let me know in the comments section down below and if you want to learn how to trade bitcoin, you can watch one of my tutorials and guides. I will see you all tomorrow. And don’t forget to huddle.

Via https://www.cryptosharks.net/black-swan-stopped-bitcoin-rally/

source https://cryptosharks.weebly.com/blog/black-swan-stopped-bitcoin-rally-important-resistance-bitcoin-trading-in-a-rising-wedge

0 notes

Text

BLACK SWAN STOPPED BITCOIN RALLY ? IMPORTANT RESISTANCE!!! BITCOIN TRADING IN A RISING WEDGE ?!?

VIDEO TRANSCRIPT

MARK COLVIN In today’s video, Bitcoin tried to break out the upside, but eventually, Bitcoin got rejected by any resistance. I want to have a look at that resistance level and why it is so significant. And in today’s video, I want to have a look as well at the possibility that the Black Swan event that we have seen that that might have stopped Bitcoins previous rally and that the price signal we are seeing on the hash ribbon right now is a repeated buy signal from Beheshti Rubin. We have seen before and right now it looks like Bitcoin is trading in this racing, which baited anyone to talk about the exact price levels that I’m watching in the bitcoin place to t to mind if we are going to see a break out to the upside and we can expect more bullish price action over when we are seeing a breakout to the downside and we can expect more bearish price action. So guys, all about that in today’s video. With that being said, my name is sure. This is the blockchain today deal channel where you subscribe for daily crypto videos. And right now, let’s jump into the content. Bitcoin’s price is still climbing. And let’s start off with having a look on the weekly timeframe. And here we can see this orange line right here and at this, the 20 weeks moving average. And in the history of bitcoin, it has been quite a significant moving average, because most of the time it was indicating whether we are in a bull or in a bear market. If we broke above the 20-week moving average, we often saw a nice run-up. And when we break below the 20-week moving average, it often acts as we shift stance. And as you can see right now, the 20-week moving average is acting as resistance. But this moving effort is lining up as well with a not a moving average, which is quite significant, and that is the 200 daily moving average. So let’s have a look into that. The 20-week moving average is right now at a proximately seven point eight K edit1, a daily moving average is right now at seven point nine case clear. There’s a little bit difference between those two, but those are both quite significant moving efforts. If we were to break a buffet and get a daily weekly close both those levels, then that is definitely looking fairly bullish for Bitcoin in the short term. In the short term time frame, it looks like the bulls starting to lose momentum. And let’s have a look what happened yesterday. So we were trading in this range almost perfectly in his range. We had actually some fake-outs here. We had a fake-out. I count consider this as well as a fake-out. Right now, we did have a break above the level. We tested the resistance. And I want to have a talk about that resistance and why I think this resistance is so significant. We got rejected. But if we have a look at the volume, we haven’t seen much increase in volume. But guys, let’s have a look at this. Reshift this line, because this resistance line is actually giving us a lot of information. Let’s shoot out the price of bitcoin. Let’s go to before our time frame so you can see right here after we had this huge dump, we bounce back up and we came. Yeah, exactly. To two. This was just this line. We tested it another time afterwards. And right now we are testing the same level again. And guys, this better’n is a rising retched Bethan and generally a rising, which is a better spread than 40. Chances are more likely that the price will break out to the downside wider than to the upside. Doesn’t mean that the price cannot break out to the upside. Of course, the price can as well break out to the upside. And the resistance of this rising ratch right now is aligning with the twenty-week moving average and its one-day moving average is slightly above that. So there is quite some resistance right now. Any bitcoin charts. So that means it’s going to be a hard time for Bitcoin to really break above those levels. But if Bitcoin breaks above those levels and can hold those levels, then that is definitely looking very bullish. But right now, I think we are trading in this channel in this rising wedge pattern. And when we have a look at the momentum indicators, I want to show you two divergences which are showing that the bulls are losing a little bit of their steam. And this first one is on the fly with time frame. We can see in the abbasi we are making a lower high right and indeed price we are making a high a high that is a bearish divergence. And that can tell us that the bulls are losing a little bit of their power and that the bearish momentum might step into the price of bitcoin. Although I do want to say from this bearish divergence before our time frame, it is not fishable on different timeframes. And most of the time it is a good confirmation when you can find these divergences on different timeframes as well. And guys, when we. Having a look at the one-hour time frame, we can see a bearish divergence as well. And Idrissi RSI. We can clearly see that every side is making a low a high end in the price. We clearly made a high a high. So that tells me that we might see some bearish momentum in the short term time frame, which could mean that we would test the support right here again, or which could as well mean that we come down and test the support of the rising, which in the near future. Ben, guys, I would like to have a look at a comment I received yesterday and I thought it is quite an interesting thought. I want to bring that up. So, Paul Rucci, he shaved about yesterday’s video. I don’t agree. You are too bearish. The capitalization at the beginning of March was a black swan event. Simply, it wasn’t meant to happen. The current has driven by is a reinforcing signal of the previous one. They are at the same price point. Previously, prices never fell significantly below the price point at the Hashwi have been by a signal. It’s going up and guys who want to have a small talk about this common because I do think Paul Rugy got a point right here and I’m just thinking about it in yesterday’s video hour. Let’s have a look at what Paul Butchie is saying here. Bull Butchy was saying is actually that this was the bottom face and this was as well the accumulation phase. And this might be a similar period as we have seen right there. So right here, we showed a minor capitulation and we saw the accumulation going on. And eventually, we got a buy signal right here. Right. And what could be the case is that after we got this buy signal, we broke out to the upside. We had this rally. But yeah, this rally stopped out right here at a proximately ten thousand and five hundred U.S. dollar. And now comes to the big question, would that really have been stopped? If we wouldn’t see this crisis right now, if we wouldn’t have that big sell-off, any stock market soared. Afterwards, we had this black swan event. And guys, a black swan event is an extremely rare event with Seafair consequences. It cannot be predicted beforehand, though many claims it should be predictable after the fact. Black Swan fans can cause catastrophic damage to an economy, and because they can not be predicted, can only be prepared for by building robust systems. Reliance on standard forecasting tools can both fail to predict and potentially increase full of ability to black swans by propagating risks and offering false security. So guys, the black swan event that we have been seeing, that is, of course, the Coldfoot 19 crises. It had severe consequences for the economy. And yet you couldn’t predict that with normal indicators we couldn’t see on the average. I write that there is a yeah, that there is a black swan event coming, that the Coldfoot 19 crisis is going to crash the stock markets. So yeah, what bull which what you’re saying is that this was the normal price action. We had this buy signal which was very bullish. Eventually, we broke out to the upside, but we got stopped. We got stopped due to this black swan event. And eventually, that makes this a repeat of the previous one. And I do think you can we can say something about this because it is an interesting fourth. I think it is definitely interesting because we had a buy signal right here. And eventually, yes, we got a black swan event and death led us to this minor capitulation. And guys, that is also important right here is one of the times we are seeing the price dumping first and afterwards we are seeing the minor capitulation. And that is logical because there is a black swan event. The economy is crashing. Surely the bitcoin price is crashing as well. And this liquidity crisis and therefore miners, they stop their operations because they simply cannot pay for the operations anymore. So they are forced to shut down, which eventually leads in capitulation in the hesh right here. So we have a price stock eventually that leads to capitulation. The Heshbon, for example, right here. It was slightly different because here we had still these price actions and we already saw capitulation happening before the dump. There was actually a very nice indicator right here that we are seeing the inversion of the hash Rayborn and afterwards the price plummets. So I think we can definitely say that this drop was as well cost by the selling pressure of the miners because we can see that back right here. These troughs are not crossed by yourself. Question of the miners. These drops eventually led to miner capitulation. And that is the interesting fourth right here. And I do think that. Yeah. Paul Voce has a point right here. We have to consider that take that into account because as well, we can see by signal right now it’s appearing at an A-s at approximately. A similar price actually, right in this rat range. So, guys. Now comes the big question. Does that make it possible that we are going to trade in this range and we will have a break out to the upside? Well, guys, that is definitely possible. And personally, I don’t think that it is the most likely scenario. I think when we have found a bottom in the stock market, that will be the moment that we are going to see a rush to sound money. We’re going to see a rush to bitcoin and gold. And right now, I’m not yet consensus that we have found a bottom in the stock market. And guys, my view on this is that indeed, I don’t think we have found a bottom in the stock market. I think we can see it is logical to see not a sell-off in the stock market. And I think the short term that that will have an impact on Bitcoin as well. I don’t think that they are fundamentally correlated as in that the price strife of the S&P 500 is similar to the price drive of Bitcoin. But I think in a crisis, the price drive. First, the fundamental price drivers are the same. And the fundamental price drive for any crisis is that everybody needs money to survive. Am I bullish on bitcoin? Yes, I’m definitely very, very bullish on bitcoin right now. We are getting a lot of bullish signals. Why? The fundamentals are looking very bullish price-wise. It’s looking very bullish. I definitely think we have seen the bottom. Any previous drop that was most likely the bottom. We are never going to get below those prices again. That is what I am thinking. But I do think that in the short term, bitcoin could still see some lowered levels to retest some lower levels. And I have some clear levels that I am watching, of course. And the first level is the resistance of the rising wedge pattern, which is aligning with the 20-week moving average. And of course, if we get a weekly close above the 20 weeks moving effort that is very bullish for Bitcoin, any short and mid-term, I would say the 200 daily moving average is slightly above that at 7.9. If we would get a daily close above that level, then that would be fairly bullish as well. I think in both scenarios we should get the confirmation that the levels are getting back tested as support as well. But I first want to see the price breakthrough and hold those levels. I think right now we are still trading in this formation. We can see the before you must still decline. We have clear support and resistance pattern-wise. It is a rising wedge pattern. And I do see some signs that there might be some bearish momentum coming into the bitcoin price in the short term. With this bearish, the Fed is only for our time frame and a balance that verges on the 1-hour time frame. But again, guys, that voices for today’s video, I hope you all enjoyed it. If so, please leave a thumbs up and let me know what you think about my analysers. Do you think Bull Ruki can be right? Was the Black Swan event something that held bitcoin down from rallying further in the past? Esti by signalling the hedge ribboned right now just a repeated version of the buy signal we have seen before. Guys, I want to know what you think. Let me know in the comments section down below and if you want to learn how to trade bitcoin, you can watch one of my tutorials and guides. I will see you all tomorrow. And don’t forget to huddle.

source https://www.cryptosharks.net/black-swan-stopped-bitcoin-rally/

0 notes

Text

Released: August 2017 Running Time: 12 minutes

“In a post apocalyptic world where the air is toxic to breathe and oxygen is a precious resource, a young boy embarks on a perilous supply run to obtain water and medicine for his ailing mother. With just his toy robot as a companion on his journey, he faces many obstacles, but the real danger is waiting for him back at home.”

I will be reviewing one short film a month, beginning with ‘The Survivor: A Tale From the Nearscape.’ The film has seen some success during its continued festival run, winning Best Sci Fi at the Festigious International Film Festival, and Best Sci – Fi at the Top Shorts Film Festival.

I’m always interested in watching movies, and with short films it is always interesting to see how the filmmakers compress the story in such a small amount of screen time.

Below is the full short film, which can be found on Vimeo and Youtube, its runtime is 11 minutes and 53 seconds. Check out my review for it below the link, followed by a Q&A with the film’s director Christopher Carson Emmons.

The Survivor Short Film – Saga Flight Entertainment

Cast & Crew

The director of The Survivor is Christopher Carson Emmons, who has worked on numerous other short films, as well as 3 full length films, and several series. Emmons also has an upcoming short film called ‘Roebling’s Bridge‘ that is mentioned in the interview with him below.

Written by Mark Renshaw who has previously written other shorts such as ‘No More Tomorrows’ in and ‘Surrender’, he’s also written a television series in called ‘So Dark’ that will be premiering soon.

Nick Kordysh as Billy – Source: Saga Flight Entertainment

The cast of The Survivor includes Nick Kordysh, Valerie Dewie Lighthart, Sam Kozé, Anna Kordysh, Alida LaCosse, Tawnie Thompson, Carl Chopp, Zach McLain, Martin Doordan, Rodney Craig Dukes and Matthew Nichols.

Review

I found that the music in the film which was done by Zaalen Tallis, was futuristic yet familiar. I really enjoyed the ambience and hectic feel that it brought to the film. It enhanced the movie, just as music is supposed to do. I did find that the music was a little loud in some points of the short, however that could just be my preference and my inexperience with short films and their style. The acting in this short was well done, especially the young Kordysh, who portrayed the main character, Billy. The other actors while doing a good job with what what they were given, had too little screen time to get to know them as well as you might like.

This slideshow requires JavaScript.

The quality in the story for The Survivor was really thought provoking and made you fear this dystopian future. We don’t have to worry about aliens or vampires or zombies in this movie, but each other. The humans in this film are what’s horrifying about this future, where people are capable of killing another human to use as food. At another point the cops are about to shoot Billy because they don’t want to have to deal with the paperwork that would be involved if they brought him in.

Roy killed Billy’s father because he wanted his mother, that is something that is reprehensible, and it makes you wonder in what kind of society would that be acceptable. It’s also telling of Roy’s character that he doesn’t acknowledge Winny anymore since she’s been sick, even going as far as turning his back to her and focusing on the television instead of trying to take care of her and lessen her suffering.

Another point that I might be misreading is at the beginning of the film, Roy is zipping up his pants after coming into the room with Billy, whatever that is supposed to imply is potentially even worse than killing the father to be with the mother.